SoftBank Wants to Acquire Chip Designer Ampere Computing in a $6.5B Deal

Chip wars are just about to begin... This looks like SoftBank is building its Stargate Alliance.

Oracle was rumored to be eyeing an acquisition of Ampere Computing a short while ago. Instead, all signs are pointing to SoftBank as the future owner of the chip maker. Carlyle Group and Oracle have reportedly promised to sell their stakes in the chip startup.

Ampere, known for its Arm-based processors, presents an enticing alternative to Intel's x86 architecture. If a financial powerhouse the size of SoftBank were to finalize this acquisition, it could indeed challenge the hegemony of x86, particularly in the cloud and data center markets.

Ampere's processors are designed with energy efficiency and scalability in mind. Oracle, for its part, would up control over the hardware that powers its cloud services.

When facing headwinds from shaky supply chains, reducing reliance on Intel and AMD's x86 processors would not be a bad thing.

At an ARM's length

Oracle owns nearly one-third (29% as of May 2024) of Ampere's shares. According to a proxy statement filed at the end of September, 2024, Oracle has the option to seize majority control of the up-and-coming chip designer in about two years, when Ampere's debts begin maturing in June 2026.

"The total carrying value of our investments in Ampere, after accounting for losses under the equity method of accounting, was $1.5 billion as of May 31, 2024," said Oracle in the filing.

Oracle extended an additional $600 million in loans to Ampere during its 2024 fiscal year in the form of convertible debt, on top of $400 million in debt carried over from the previous fiscal year.

Oracle has the option to convert these investments into equity to acquire control of Ampere. This won’t happen if the SoftBank deals goes through.

The document also revealed that Oracle spent approximately $48 million on Ampere processors during its 2023 fiscal year—some purchased directly from Ampere, some through third parties. By comparison, Oracle spent only $3 million on Ampere's chips in fiscal year 2024 but had $101.1 million worth of products available under a pre-payment order. Ampere is clearly cash strapped.

Yet these numbers look like peanuts when you consider that both SoftBank and Oracle are on the Stargate Project of the Trump Administration.

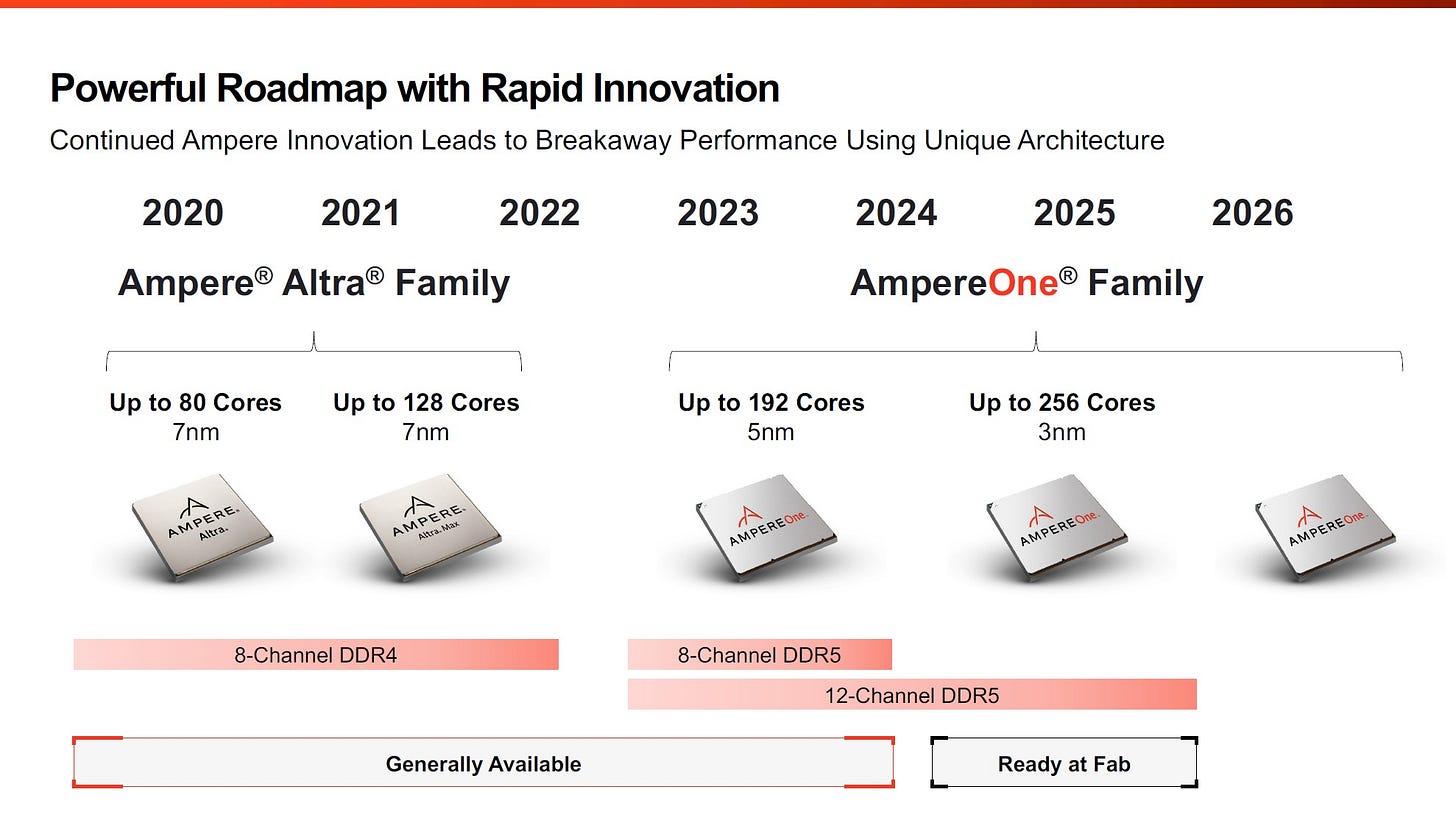

Ampere’s roadmap looked promising even before that. A thousand (1,000) semiconductor engineers are reportedly working on it.

Amping up

The AmpereOne family of chips debuted in 2023 and is on track to redefine the scalability of CPU architectures. Ampere is keeping mum about much of it.

Some key highlights of upcoming designs include Ampere's amped-up AmpereOne cores in Arm architecture, the AmpereOne mesh, and a die-to-die interconnect comprised of a custom SERDES (serializer/deserializer that facilitates communication across chiplets) and a customized protocol.

ARMed to its teeth

All indications seemed to suggest that Oracle aims to manufacture its own chips for its data centers to reduce its reliance on Nvidia, Intel and AMD. Now that is no longer the case.

Given the increasing role of AI and machine learning in data processing and cloud workloads, a chipmaker is a bank’s best friend.

This acquisition has the potential to shift the balance between x86 and Arm, for better or worse. Stay tuned.